|

|

|

| Thu Mar 5, 2009 - 9:23 AM EST - By Annie Latham | |

|

|

|

You're hot then you're cold

You're yes then you're no

You're in and you're out

You're up and you're down

You're wrong when it's right

It's black and it's white

We fight, we break up

We kiss, we make up

As I was reading through the various write-ups and reactions to Palm's latest news, the jukebox in my brain started playing Katy Perry's "Hot N Cold" song.

My colleague Dieter did a great job summarizing Palm's preliminary Q4 results, which he characterized as "grim." Over at All Things Digital, John Paczkowski noted that Palm burned through between $95 million and $100 million during the quarter, making quick work of the investment Elevation Partners made in it last December.

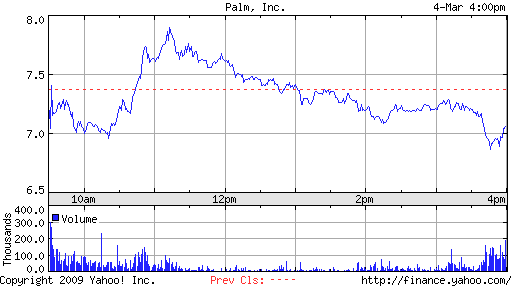

Good point. It certainly looked like PALM stock would be pummeled in after hours trading leading into a really nasty Wednesday. Seeing the stock up midday was a surprise. What the...?

Michael Walkley of Piper Jaffray upgraded PALM to Buy from Neutral following the negative pre-announcement of Q3 results, raising the target price to $10 from $4 Source: TheStreet.com.

"We believe several carriers plan to launch the Palm Pre, and despite the challenging macro environment we anticipate this unique product will resonate with consumers," said Walkley.

Several carriers? Perhaps he's talking on a worldwide basis. Otherwise, I'm sure that was news to Sprint.

Another interesting story appeared at TheStreet.com where Scott Moritz posted a story with the headline: "Palm's a Fit for Hewlett-Packard." Taking a fortune-telling angle, he wrote:

"A Palm reading tells two fortunes: It's either a dire broken life line, or it's swept off its feet to a happy ever-after by a suitor like Hewlett-Packard."

In his story, he quoted Collins Stewart analyst Ashok Kumar who believes that Palm's crown jewel is webOS, the new operating system on the Palm Pre. For companies like Hewlett-Packard, Palm would be a "bite-sized and accretive" move allowing them to "increase their footprint in consumer devices," said Kumar.

Based on these stories, it is understandable why PALM had a little rally going.

It was also reported at TheStreet.com that Goldman lowered its target price for PALM but maintained its Neutral rating.

In his story titled, "Palm shares rise despite sharp revenue miss," Dan Gallagher of MarketWatch described Jim Suva of Citigroup as maintaining a cautious view on the stock. Suva wrote:

"While many expected February sales to be challenged given the gap before the Pre product launch, the magnitude of the miss underscores our concerns for lack of support for Treo Pro and other Palm products and risks of carrier inventory workdown as Palm users wait for the Pre."

Gallagher also stated that Charlie Wolf of Needham is remaining neutral on the shares, noting that the Pre faces the risk that more competing smart phones will be on the market by the time of its launch.

For an excellent roundup of the morning commentary on PALM, check out the Tech Trader Daily story posted by Barron's West Coast Editor Eric Savitz which includes thoughts from Canaccord Adams analyst Peter Misek, RBC Capital's Mike Abramsky, Barclays Capital analyst Amir Rozwadowski, Morgan Keegan's Tavis McCout, C.L. King analyst Lawrence and Cowen's Matthew Hoffman.

One more for the road... Benjamin Pimentel at MarketWatch.com wrote about S&P lowering Palm's corporate credit rating to 'CCC' from 'CCC .' S&P credit analyst Bruce Hyman said in a statement that the move reflects "significant further declines in revenues and liquidity."

It makes sense why there was a lot of movement in the opposite direction, with PALM closing at $7.06.

There is definitely a feeling in the air that time is running out. You can almost hear the ticking of the clock from the television show "24" as we all await the arrival of the Pre. In a follow up story, humorously titled, "Palm: Believe It or Not, I'm Walking on Air," John Paczkowski wrote:

"Buzz around the device continues to build, with some consumers postponing new handset purchases in anticipation of the Pre. But Palm better act soon. Because the longer it waits to bring the device to market, the closer we are to Apple's (AAPL) next refresh of the iPhone, which will invariably suck all the air out of the smartphone room."

Eric Bleeker at Fool.com in his piece, "Palm's Race Against the Clock", probably summarized the situation best:

From this Fool's perspective, the Pre shows quite a bit of promise. Not only is it a game-changer for Palm, it also provides a sorely needed shot in the arm for exclusive cell provider Sprint, which will heavily market to the new gizmo. However, yesterday's news accentuated some of the risks involved with this rocketship of a stock. Tough time to launch a product, tough competition, tight timeframe. Proceed carefully -- Palm's already thin margin of error just got a bit slimmer.###

Disclosure: I do not own stock in Palm, Sprint, or Apple.

Copyright 1999-2016 TreoCentral. All rights reserved :

Terms of Use : Privacy Policy

TREO and TreoCentral are trademarks or registered trademarks of palm, Inc. in the United States and other countries;

the TreoCentral mark and domain name are used under license from palm, Inc.

The views expressed on this website are solely those of the proprietor, or

contributors to the site, and do not necessarily reflect the views of palm, Inc.

Read Merciful by Casey Adolfsson