On Monday, it was reported that Kevin Dede at Jesup & Lamont put out a research note rating PALM stock a Sell with a $12.50 price target due to the company's shares being overvalued, particularly in light of Pre returns. In the story posted by Digital Daily's John Paczkowski titled "Palm Valuation Not All It's Cracked Up to Be," more details were provided to support the Sell rating.

Dede wrote:

"... our checks now lead us to believe that while initial sales could almost be categorized as 'gangbusters' and perhaps above initial assumptions, we think there are engineering complications that are driving a higher level of returned devices than otherwise expected."

He goes on to explain that "...we understand that a great many returns are on account of an unsatisfactory experience with the keyboard operation and dead pixels in the screen. Fixing these issues shouldn't pose a problem, but we think the timing risk and severity should be reflected in the shares."

So here's where it gets interesting. He mentions our sister site, PreCentral.net as a source of his returns data, along with numbers from his impromptu survey of local retail outlets (Sprint, Best Buy and Radio Shack).

"...a survey on Pre Central that suggests roughly 40 percent of initial Pre sales are exchanged."

Hold on there, said PreCentral's Dieter Bohn, who did a post titled, "Analyst Claims Palm Pre Return Rates Are High. We're Not so Sure." He wrote:

"So does the Pre have a high return rate? Palm says nope, a survey in our forums and Dede's calls to local retailers say yep. We say anybody who makes investment decisions based on either needs to rethink their retirement strategy."

To help clarify things, Dieter has set up a survey in his post (as opposed to the forum survey info that was being used), where he asks one question:

Have you returned or exchanged your Pre because of build quality issues?

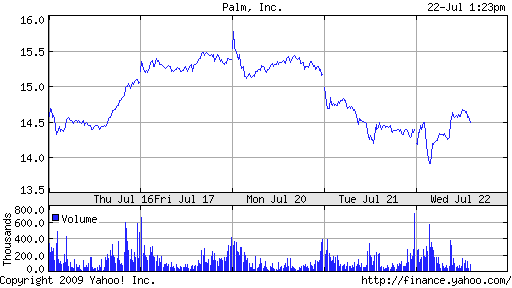

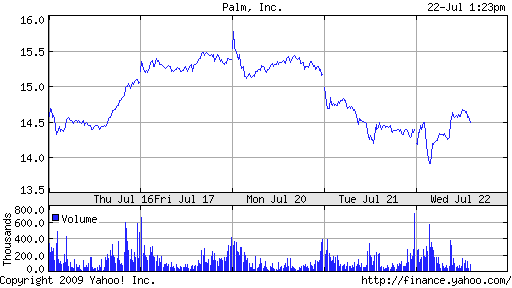

So there you have it... PreCentral in the middle of a story that could impact Palm's stock. Then again, a quick look the closing prices for Monday and Tuesday seem to show this as a blip. Apple and its earnings is the 800 pound gorilla.

###

Copyright 1999-2016 TreoCentral. All rights reserved :

Terms of Use : Privacy Policy

TREO and TreoCentral are trademarks or registered trademarks of palm, Inc. in the United States and other countries;

the TreoCentral mark and domain name are used under license from palm, Inc.

The views expressed on this website are solely those of the proprietor, or

contributors to the site, and do not necessarily reflect the views of palm, Inc.

Read Merciful by Casey Adolfsson