Delta%? � compute percent change

Percent applies a percentage to the number you specify. So, if you want to know what is 35% of some number, tap the number, then %, then the = button. Tap 56.95, %, 25, = 14.2375.

Percent change computes the total that results after applying a percentage, plus or minus, to it. For example, that antique Tux penguin in your geek boutique at an 85% markup. Tap 5.50 (your cost), Delta%, 85, and the big = button. The penguin's price tag is $10.18.

The %? button computes "What percentage of this is that?" The first number you enter is the comparator, and second is the comparatee. So, first number 100, second number 50. It's like asking "What percentage of 50 is 100?" Tap 100, %?, 50, and the answer is 200.

Delta%? is similar. It figures out by what percentage you'd have to multiply the second number to get the first. Enter 100, tap Delta%?, tap 85 and =. You'd reap a 17.6470588% markup on an $85 item to charge $100 for it.

Example: That new car you want to buy me has a $50,000 sticker price. You can finance it at Greedmongers Bank and Trust for 5% annual percentage rate on a 24-month term, and the payments will be� you figure it out. And please send over the ignition key soon.

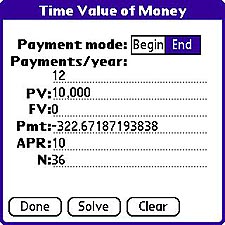

Example: Monthly payment on a $75,000 thirteenth mortgage, 30 years at 5.5% annual percentage rate. Set Begin/End to END.

Set Payments / year to 12

Set PV to 75000

Set FV to 0

Erase any entry in Pmt and leave it blank (not 0, blank!)

Set APR to 5.50

Set N to 360 (=30 years times 12 payments per year)

Tap Solve and the payment amount appears in the Pmt line: 425.84175101025.

Using the Amrt function, you find out that the last payment tidies up $423.90 of principal and $1.94 interest, leaving a balance of zip. The payment has a negative sign because it's cash out. To have the calculator allow for beginning and ending payments, subtract them (add, if it's cash incoming) from the present and future values. So, $75000 minus your $12,500 down payment leaves a mortgage of $62,500.

Another useful example: Money in savings accounts (wise). If you open an account for, say, $5,000, how much will you have after 20 years at 5% interest?

Set Begin/End to END

Enter 12 for payments per year (monthly)

Enter 5000 for PV

Clear the FV line entirely

Enter 0 of Pmt (we don't need that variable)

Enter 0.50 for APR

Enter 240 for N (5 years, in months)

Tap Solve and you get a FV of 5,525.7395015745

Your mileage will vary according to the number of times during a year the interest is compounded. For example, the TI model BA-plus calculator assumed a quarterly compounding and came up with $5,524.48 instead.

Conclusion

The Treo 650 and 700P include powerful math, trigonometry, and financial calculators, and that's just the beginning. Curious that the powerful features aren't documented in Treo manuals, but the information in this and the next part of this continuing saga should get you going.

Copyright 1999-2016 TreoCentral. All rights reserved :

Terms of Use : Privacy Policy

TREO and TreoCentral are trademarks or registered trademarks of palm, Inc. in the United States and other countries;

the TreoCentral mark and domain name are used under license from palm, Inc.

The views expressed on this website are solely those of the proprietor, or

contributors to the site, and do not necessarily reflect the views of palm, Inc.

Read Merciful by Casey Adolfsson

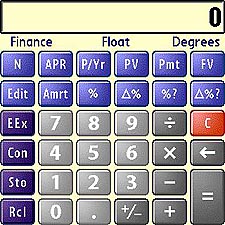

Here's a real money maker. Or not. We often need the functions of the Treos' Finance calculator, even if we don't know it. This one makes everybody a tycoon. Use it to calculate the future value of an investment, or figure out the required present value of something, given its value at some future time.

Here's a real money maker. Or not. We often need the functions of the Treos' Finance calculator, even if we don't know it. This one makes everybody a tycoon. Use it to calculate the future value of an investment, or figure out the required present value of something, given its value at some future time.

The Treo's equation deals only with evenly spaced, equal cash flows (Payments), which can be either intake or outgo. Tap the Edit button and let's take a look. The monikers are all jargon to the finance set, but here they are in English:

The Treo's equation deals only with evenly spaced, equal cash flows (Payments), which can be either intake or outgo. Tap the Edit button and let's take a look. The monikers are all jargon to the finance set, but here they are in English: