The news from Sprint Nextel, the mighty cell phone carrier, has been bleak. Really, the news has been super bleak for a while, now. Theres not much letup in sight.

Take this months second-quarter financial results released last week, for example. Lots of red ink. Reporting a $344 million loss, Sprint said its making progress on a comeback. Big thrill, theyre losing money at a slower rate. Great news! Well, theyre still losing money. That negative 344 mil compares with a 19-mil profit in last years second quarter. Sales dropped by 11 percent. Subscribership (you know, those hideous contracts they make us sign?) dropped, too.

Cell carriers worry about two types of customers: pre-paid and post-paid. A post-paid subscriber, like me, gets a bill at the end of the month. And pays it. A pre-paid customer coughs up cash up front. In Sprints case, most of the pre-paid customers are due to resellers, partners, or what have you. To impress industry pundits, you have to keep your customers, a tall order when your competitors are constantly advertising cool new phones.

In the second quarter, Sprint Nextel lost 776,000 post-paid subscribers. Number One, AT&T, and Number Two, Verizon, both gained customers. This is not good news for Sprint.

Sprints CEO, Dan Hesse, who is challenged with the turnaround, said during the companys second quarter conference call with investors that the company has increased credit score requirements, closed stores, and become more selective for customers brought into its fold. We really are focusing on higher-value subscribers, Hesse said.

As a Sprint customer, Im not overjoyed to be considered a commodity, but lets keep going. Management says the company is looking at the total value of a customer to drive higher ARPU. Thats average revenue per user. Meaning how much they make off of each customer. The strategy doesnt altogether impress the industry analysts. If it works, however, theyll all be impressed. In the second quarter, Sprints ARPU was just over $50 per line. Somebodys getting a deal. Theyre making more than that from me.

Continued subscriber losses and investments in customer service improvements are taking a toll on both top-line and bottom-line growth, said Kate Price, an analyst at NBQ Technology Business Research

Some of Sprints subscribers have been demonstrative about their dissatisfaction. Check out sprintpcs-sucks.com, sprintrants.com, and others.

For the record, Sprints first-quarter losses totaled $505 million. If anybodys counting, thats $849 million so far this fiscal year. If I lost even half that much in three months time, my landlord would bounce me out of here pretty fast.

What else is going on

Okay, Sprint news is way bad for the second quarter, but how about the third? Helloooo? Thats the quarter that were in right now.

Sprint Nextel currently expects to report higher post-paid subscriber losses in the third quarter due to a seasonal uptick in churn when compared with second quarter 2008 results, the company said. We expect sequential declines in post-paid gross adds to moderate, and we expect modest pressure on post-paid [average revenue per user] for the balance of 2008. This combination of factors is expected to result in a sequential reduction in Adjusted [operating income before depreciation and amortization] for the third quarter.

Translation: More bad news is probably coming soon to a press release near you. Churn refers to the goings and comings of customers. Churn is bad. Both of the bigger dogs in Sprints pen have much less churn.

Hesse again:

We are seeing signs of progress from our efforts to improve the customer experience, rebuild the Sprint brand and increase our profitability, said Hesse. Our company-wide retention efforts, which include Simply Everything plans, our Now Network campaign and the launch of the Instinct handset are proving to be effective retention tools, particularly for high-value customers, and this is beginning to have positive impacts on churn and ARPU. Our sequential improvement in post-paid churn is the best reported by any national wireless carrier since 2004, and it equals Sprints best-ever churn performance post-merger.

Ah, merger, thats the rub. Many analysts attribute the carriers present troubles to sins of its past. Namely, buying Nextel in 2005. The Nextel network wasnt compatible with Sprints, and still isnt. It appears that Nextels customer base isnt moving to Sprint-capable phones, either. Theyre just moving to other carriers.

During the conference call, Hesse spoke of improving the companys infamous customer service, in order to improve the customer experience. If he really wants to improve the customer experience Im speaking as a customer, here he could work on the experience of going into shock when opening the monthly bill. However, Hesse says the company is determined not to reduce rates. Hes got a long way to go to fix the carriers customer service, too. Its still a nightmare.

To increase profitability, we are taking a more aggressive stance on reducing costs, including a more stringent spending review process, minimizing external labor costs, and we have streamlined our distribution channels by more than 25 percent since the beginning of 2008. Further, our disciplined customer credit and collections efforts have reduced bad debt and strengthened the credit profile of our customer base.

Id still be a lot happier customer if I paid less for, say, unlimited texting, which is vastly overpriced at all the carriers and costs little to operate. Hesse: "You shouldn't anticipate that we'll be looking at cutting prices as a way of attracting subscribers.

Buyout or sellout

When companies get in money trouble, it seems, theres always some bigger company willing to step in and take over. They tick off, lay off or fire all the good employees, botch the marketing, obliterate the target companys reputation and corporate identity, and alienate all the old companys loyal customers. Isnt that right, AT&T? Think NCR first, and now Cingular.

So, its not surprising that the rumor mills have been way festive about a Sprint buyout. Or sellout. First there was a mysterious Korean company interested in picking up where common sense left off; then it was Deutche Telekom looking at buying the ailing carrier. Currently its nobody at all, which is probably closer to the truth. Or maybe theres a surprise in the works that even the rumor mills dont know about. Yet.

Though the company has repeatedly said it has plenty of cash to keep going, Sprint announced in July that it sold around 3,300 of its towers to a private tower company, TowerCo, for about $670 million in cash. That leaves only a handful of towers to own and manage. While competitors have also sold off their towers to large firms, Sprint has always managed its own. Dont read too much into the selloff, however. Sell/leaseback arrangements are common in business.

Sprint now plans to lease the towers for its cellular network as well as the WiMAX network it is helping to build. They said theyll use the proceeds to pay down some of its $24 billion in debt, and the Wall Street Journal has reported that the company is considering a sale of even bigger assets, like their Nextel iDEN network. Thats the push-to-talk network that Sprint paid $35 billion for in 2005. My money says they wont get anywhere near $35 bil for it.

When Sprint said last quarter that it might sell off some assets, the company also said it might seek waivers or amendments from its creditors, but has enough cash to continue operations and repay all of its maturing debts through the end of 2009.

WiMAX Why Not?

The companys in the news this week for their grand plan to deploy a technology called WiMAX service with partner Clearwire Corp., with which Sprint is planning to merge by the end of the year if the Powers That Be dont mind. AT&T has filed objections with the FCC, which gets to approve the plan (or not).

Clearwire lost money in the second quarter, too, though its a much smaller company. Clearwire said its losses increased in the second quarter to $199 million (wow!) on revenue of $58.6 million, compared with a same-quarter-year-ago loss of only $118 million on revenue of $35.5 million. The company plans to deploy certified mobile WiMAX in select markets later this year.

It added 18,400 customers in the second quarter, a growth of 54 percent over 2007. Google, Intel and cable companies have invested $3.2 billion in the new company. Intel makes the toys that enable the network. Clearwires CEO, Ben Wolff, said during the company's conference call with investor analysts that Clearwire's WiMAX deployment is ramping up to launch in Portland, OR, in the fourth quarter. Clearwire's networks in Atlanta, Las Vegas, and Grand Rapids, SD, could also be launched by the end of the year, but the timing of their deployments depends on whether the deal with Sprint closes on time and whether Clearwire will pursue additional funding in the interim.

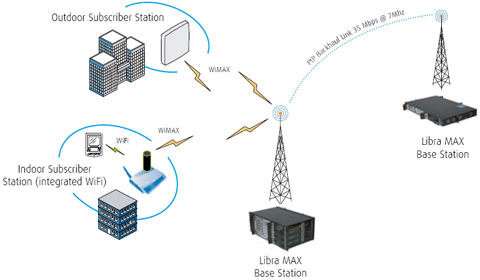

Note: I lifted the picture from Eion Wireless, an equipment seller. Thats not necessarily the type of equipment being deployed. I just liked the illustration.

Commercial WiMAX, which Sprint is also deploying, is a new wireless network technology that is being considered by some carriers to supplant some land-based wiring. Sprint plans to launch WiMAX in Baltimore next month.

Now the good news

Sprint managed to oust AT&T starting this fall as a sponsor of a widely screened cell phone courtesy campaign for movie theaters. National CineMedia of Denver contracted with Sprint to sponsor public service announcements encouraging moviegoers to turn off their cell phones.

The Sprint announcements, which are being developed by Goodby, Silverstein & Partners of San Francisco, will be seen at more than 1,100 theaters in the U.S., beginning in October. AT&T sponsored the ads since 2007, after its acquisition of Cingular Wireless a year earlier, as Cingular had done since 2001.

According to the Wall Street Journal, the president of Verizon, Denny Strigl, told investors that Sprint's performance over the last month has improved. Of course, he also said that the improvements haven't impacted Verizon. In this storm of doom, any good news is way welcome.

Conclusion

I cant close without mentioning the Palm Centro, and the fact that Sprint has undoubtedly benefited handsomely from backing Palms hot selling little phone from the beginning. Those negative numbers might have been even worse otherwise.

Im glad Im not Sprint. Or Hesse - though I wouldnt have any trouble making ends meet on his salary, the highest in the industry according to the Associated Press, at $28.3 million.

The whole system is whats out of whack, not just Sprint. The phone companies shouldnt be in charge, and they are. People should buy the phone they like the most and use the cell carrier they hate the least. The companies should compete for quality of service, extent of coverage, and customer service, not which phone has the most or coolest features. Is anybody listening to me out there? I didnt think so.