Palm, Inc. yesterday reported revenue of $392.9 million in the second quarter of fiscal year 2007, ended Dec. 1.

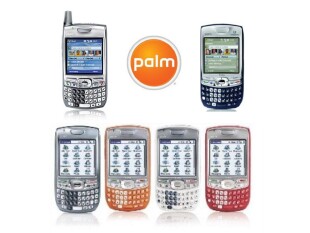

Palm reported strong Treo sell-through this quarter-- a company record-high 617,000 units, up 42 percent year over year and up 8 percent sequentially as more customers throughout the world bought Treo smartphones than ever before.

Net income in the fiscal quarter totaled $12.8 million, or $0.12 per diluted share. Net income included stock-based compensation expense of $6.5 million and amortization of intangible assets of $0.3 million. This compares to net income for the second quarter of fiscal year 2006 of $260.9 million, or $2.51 per diluted share. The second quarter of fiscal year 2006 net income reflected the effect of a partial reversal of a deferred tax-asset valuation allowance of $226.3 million.

"We are pleased to report strong Treo sell-through this quarter, which is one of the most important metrics. More customers throughout the world bought Treo smartphones than ever before," said Ed Colligan, Palm president and chief executive officer. "In addition, we accomplished a number of strategic objectives during the quarter: shipping two new Treo models to expand both geographically and demographically, securing perpetual rights to the Palm OS source code, and diversifying our manufacturing partners to strengthen our cost position and our product pipeline."

Based on current trends, Palm provided its outlook for financial results in the third quarter of fiscal year 2007, which ends March 2, 2007. The company expects the following:

Revenue to be in the range of $400 million to $410 million;

Gross margin to be between 35.8 percent and 36.3 percent on a GAAP basis and between 36.0 percent and 36.5 percent on a non-GAAP basis;

Operating expenses to be between $134 million and $139 million on a GAAP basis and between $128 million and $133 million on a non-GAAP basis;

Annual tax rate on a GAAP basis of 41 percent and, on a non-GAAP basis, 40 percent;

Earnings per diluted share to be between $0.08 and $0.10 on a GAAP basis and between $0.11 and $0.13 on a non-GAAP basis; and

SFAS 123R stock-based compensation expense, before taxes, to be between $5.5 million and $6.0 million and amortization of intangible assets to be $0.3 million. These amounts and the related income tax amounts are excluded from Palm's third quarter of fiscal year 2007 outlook on a non-GAAP basis.

Hopefully Palm's profits will increase over the next year. Even though their profits saw a decline, the company had a very high sell-through on their Treos with so many customers buying their phones.

Palm is working hard at improvements with their newest senior vice president of marketing, Brodie C. Keast, their new advertising campaign, and the upgrade of their Palm Help forum. And of course all those snazzy new Treos don't hurt either. ;-)