treocentral.com >>

Stories >>

Business

Again?! Palm Takeover Rumors Resurface...

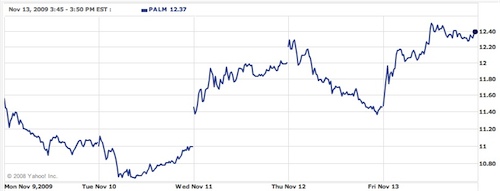

Here we go again. This Friday the 13th, the rumblings have been about Nokia potentially buying Palm. The Reuters story quoted Frederic Ruffy, option strategist at WhatsTrading.com who said,"Palm shares jumped and its call volume surged to 9 times their normal level as more than 80,000 call contracts traded by midday on renewed takeover speculation." Ruffy also noted that in September, the speculation was that Nokia might bid for Palm -- but nothing ever happened and Palm shares have been down 30 percent since then. Here we go again. This Friday the 13th, the rumblings have been about Nokia potentially buying Palm. The Reuters story quoted Frederic Ruffy, option strategist at WhatsTrading.com who said,"Palm shares jumped and its call volume surged to 9 times their normal level as more than 80,000 call contracts traded by midday on renewed takeover speculation." Ruffy also noted that in September, the speculation was that Nokia might bid for Palm -- but nothing ever happened and Palm shares have been down 30 percent since then.

Another point raised in that story was that a deal for Palm would be unlikely because "any buyer would have to pay more than $2 billion, and then sink more in to marketing and distribution." In the case of Nokia, it might be better to license webOS rather than go all in and buy the company.

Digital Daily's John Paczkowski, in his story (titled "Nokia Buy Palm? Riiiiight...") had this to say:

"At $12.34 Palm is up well over 7 percent as I write this, a nice gain that more than offset the 4 percent drop the company's shares suffered last week. Clearly, the market is expecting a lot of the Pixi, and according to some analysts it may get it. In a note to clients Friday, RBC analysts said that they 'expect positive consumer reception and healthy sell-through,'for the Pixi."

Balancing things... on the downside, Ashok Kumar, an analyst at Northeast Securities, said in published reports that his sell-through checks show a "substantial decline" in recent Pre sales.

It will be interesting to see how things shape up next week when Pixi arrives.

###

|

|

|

|